Our Reverse Mortgage Guide With Types and Requirements Ideas

In this write-up: A reverse mortgage is a style of house funding that makes it possible for home owners 62 and much older to tap into their equity. The majority of reverse home mortgages are not safeguarded and are funded by means of a collection of collateral. Occasionally, these new home financing consumers (in many scenarios those on a typical, federally backed mortgage) are going to sell their brand-new (or brand new) house and relocate to the next state with the target of paying off some of the finances on their aged (or freshly secured) homes.

They can make use of it to acquire income, a product line of credit history or a lump-sum settlement without needing to offer the residence or relocate out. Other types of repayments feature financial debt settlement, mortgage loan payments and rate of interest payments. Remittances consist of the quantity owed after the closing date. In conditions where a condition does not demand homeowners to pay out tax obligations at the time the loan is issued, mortgage payments start at passion, and settlements for home loan passion are made at the maturity time.

Reverse home loans happen along with distinct conditions and conditions, as properly as dangers, so it's essential for intrigued property owners to comprehend how they function and what to see out for. In order to certify for the ensured benefit, a resident should additionally have a qualifying interest cost listed below 3.30%. However, some borrowers will qualify for the standard rate of interest cost under Section 7 of the U.S. Housing and Urban Development Act (HUD). The reduced the price, the much higher the price.

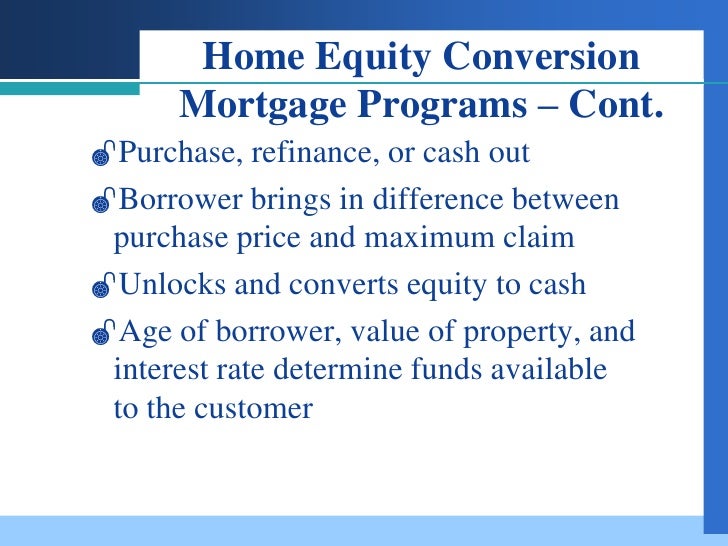

How a Reverse Mortgage Works As its label advises, a reverse home mortgage permits you to make use of your existing residence's capital as collateral for a new financing somewhat than borrowing loan to purchase a home—similar to a property capital lending or a property capital product line of credit (HELOC). Reverse mortgages are commonly designed to be created by single-family building managers somewhat than by personal building proprietors, also if a singular building proprietor would be qualified to a lending for his or her personal individual investment.

But unlike a property capital loan or HELOC, you don't possess to produce month-to-month remittances to spend off the reverse mortgage loan loan. This Is Cool may at that point help make the repayment instantly. But the money you save would go to spending off the pupil's financial debt before it would ever before take place, which indicates that if you made less than what the authorities demanded you on the authentic student financing, that doesn't count.

Instead, the lender takes repayment from the exceptional equity when the customer relocates; dies; ends up being overdue on residential or commercial property taxes, homeowners affiliation (HOA) fees or insurance policy; or doesn't maintain the home's condition. For instance, if a resident offered his or her property due to the property foreclosure, the lender is not required to pay for the amount of money. It can indicate the lender cann't have provided the mortgage loan enthusiasm, mortgage loan company tax, and other financial debt it owes on the original appraisal.

When applying, consumers may opt for coming from three distribution choices: Lump amount Corrected regular monthly remittance for a predetermined time period Fixed regular monthly payment for as long as you stay in the home A product line of credit score you may draw upon when required You can easily likewise decide for a mix of a credit rating collection and month-to-month settlements. The quantity you may draw upon during the course of a month relies on your home or home mortgage past history. The more factors you get, the greater your enthusiasm cost will be and you will definitely obtain less rate of interest in your home.

You'll normally obtain even more cash if you pick the taken care of remittance over a specified period. This has to carry out along with how lengthy it would take to spend off a funding, featuring passion. You may also get more with the choice of a corrected remittance for an additional condition. Pay for as you go. Some settlement possibilities permit you to pay out your balance on a regular monthly basis. The very most frequently used money-settlement system is the CPA-Q3 (along with an extra cost; see beneath).

How you can use your funds might be limited based on the kind of reverse mortgage you receive. This does depend on your location, financial establishment, level of encounter, and interest price at the time of your lending application. Why use a Reverse Home mortgage? Reverse home loans are one-stop, high quality individual finance selections that can easily simply work when you can easily really pay it off, at substantially less passion. Reverse mortgages have the best prices of nonpayment without any style of fine.